A Guide to Competitive Analysis Frameworks

A competitive analysis framework is essentially a model that helps you organize all the messy, scattered data you have on your rivals. Instead of just a pile of facts, you get a clear, strategic picture. Think of it less like a rigid rulebook and more like your company's personal battle map for navigating the market.

Understanding Your Strategic Battle Map

Trying to analyze your competitors without a structured approach is like trying to solve a puzzle with half the pieces missing. You might collect interesting tidbits—a rival’s new pricing, a clever marketing campaign, a sudden spike in their social media followers—but these isolated facts don't tell you the whole story. A good framework provides the structure needed to assemble these pieces into a coherent, actionable view of your entire market.

This "battle map" elevates you from a simple observer to a strategic player. It’s the difference between knowing a competitor launched a new product and truly understanding why they launched it, who they're targeting, and what it means for your own market share. That deeper insight is what allows you to make smarter, faster decisions.

Why a Framework Is So Important

A structured framework is more than just an organizational tool; it's a strategic multiplier. It keeps your analysis consistent, repeatable, and focused on what actually matters. Instead of drowning in an endless sea of data, a framework points you directly to the information needed to answer your most critical business questions.

By organizing how you gather intelligence, a framework helps you anticipate market shifts and competitor moves—putting you in a proactive position instead of a reactive one. It provides the clarity you need to turn insights into a real competitive advantage.

For instance, a solid framework helps you spot not only your direct, obvious rivals but also the emerging disruptors who might be flying under the radar. It also forces you to look at your own business with an honest eye, showing you where you're strong and, just as importantly, where you're vulnerable. Having this repeatable process is the foundation for building long-term strategic agility.

Ultimately, using a competitive analysis framework helps you:

- Identify Market Gaps: Uncover underserved customer needs or entire market segments your competitors are overlooking.

- Refine Your Strategy: Use what you learn about competitor weaknesses to sharpen your own strengths and unique value proposition.

- Benchmark Performance: Objectively measure your success against the established players in your industry.

- Make Data-Driven Decisions: Replace guesswork and gut feelings with strategic planning that's backed by solid evidence.

Choosing Your Strategic Analysis Model

Alright, you've gathered your competitive intelligence and have a solid lay of the land. Now what? The next move is to pick the right lens to analyze it all. A competitive analysis framework isn't a one-size-fits-all solution; think of it as a specialist's toolkit. Each tool is designed to bring a different aspect of the competitive environment into sharp focus.

Choosing the right model really boils down to the questions you're trying to answer. Are you looking inward to assess your company's health against the outside world? Or are you trying to figure out if your entire industry is a profitable place to be in the long run? The framework you select will steer your analysis and ultimately shape the insights you walk away with.

It’s like a doctor choosing a diagnostic tool. An X-ray is perfect for finding a broken bone, but you'd want an MRI to get a detailed look at soft tissue. In the same way, a SWOT analysis is your go-to for a quick health check-up, while Porter's Five Forces is the deep-dive MRI for scanning your industry's competitive intensity.

The Foundational SWOT Analysis

There's a reason the SWOT analysis is one of the most well-known frameworks in business. It’s incredibly straightforward yet powerful. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats.

The genius of SWOT is how it splits your analysis into two distinct categories:

- Internal Factors: These are your company's Strengths and Weaknesses. Think of things like your team's unique skills, your proprietary technology, or your cash flow. These are elements you have some control over.

- External Factors: These are the Opportunities and Threats lurking in the market. This could be a new customer trend, a looming regulation, or a competitor's big move. You can't control these, but you can react to them.

Mapping these four quadrants helps you see exactly how to use your internal strengths to capitalize on external opportunities. It also shines a light on where your weaknesses might leave you vulnerable to market threats. Understanding these dynamics is a critical part of building a narrative around your business, which is fundamental to creating a strong brand identity.

A SWOT analysis forces a moment of real honesty. It makes you look in the mirror to see what you do well (and what you don't) and then look out the window at the forces that could make or break you. This balanced perspective is its true power.

For instance, a tech startup might list its "agile development process" as a Strength but "low brand recognition" as a Weakness. An Opportunity could be a newly identified niche market, while a major Threat might be a tech giant launching a similar product. This simple grid immediately helps clarify what to do next.

Gauging Industry Heat with Porter’s Five Forces

While SWOT gives you a snapshot of your company's position, Porter’s Five Forces zooms out to analyze the entire industry. Developed by the legendary Harvard Business School professor Michael E. Porter, this model is all about determining an industry’s structural attractiveness—in other words, its potential for long-term profitability.

The five forces that shape every industry are:

- Competitive Rivalry: How cutthroat is the competition between existing players? Intense rivalry can trigger price wars, high advertising spend, and thinner profit margins for everyone.

- Threat of New Entrants: How easily can a new company set up shop in your market? High barriers to entry, like huge startup costs or powerful existing brands, act as a moat protecting current businesses.

- Threat of Substitute Products or Services: Are there other ways for customers to get the same job done? Think of how video conferencing became a major substitute for business travel.

- Bargaining Power of Buyers: How much leverage do your customers have to demand lower prices? Their power is high when they have many options to choose from.

- Bargaining Power of Suppliers: On the flip side, how much power do your suppliers have to jack up their prices? Their power is high if they are one of only a few providers of a critical component.

By rating the intensity of each of these five forces, you get a clear picture of the underlying power dynamics in your market. It's an indispensable step before making a major investment or deciding to enter a new industry.

PEST Analysis for a Macro View

Finally, if Porter's Five Forces is the industry-level view, a PEST analysis zooms out even further to the macro-environment. This framework—sometimes expanded to PESTLE to include Legal and Environmental factors—helps you spot the big, overarching trends that could affect everyone.

PEST is an acronym for:

- Political: How do government policies, political stability, and trade regulations impact the market?

- Economic: What's the effect of economic growth, interest rates, inflation, or exchange rates?

- Social: What cultural norms, demographic shifts, or changing consumer attitudes are at play?

- Technological: How are new inventions, automation, and R&D activities changing the game?

A PEST analysis is your long-range radar. It’s crucial for strategic planning because it helps you anticipate massive shifts that could either make your business model obsolete or open up incredible avenues for future growth.

How to Build Your Analysis Framework

Knowing the theory behind competitive analysis is one thing, but actually building a system that churns out valuable insights? That's where the magic happens. A solid competitive analysis framework isn't just about grabbing random data points on your rivals. It’s about creating a repeatable, structured process that transforms market noise into clear, strategic action.

Think of it like building a custom dashboard for your car's engine. It tells you exactly what’s happening, where the pressure points are, and when you need to make a tune-up before you break down. The best frameworks follow a logical flow, moving from a wide-angle view of the market down to specific, actionable steps.

To create a system that consistently delivers, we'll walk through a proven three-phase process: Assess, Benchmark, and Strategize.

Before we dive into the details of each phase, it's helpful to see how they fit together. This table breaks down the entire process into its core components.

Core Phases of a Competitive Analysis Framework

| Phase | Objective | Key Activities |

|---|---|---|

| 1. Assess | To identify and categorize all relevant competitors in your market. | Mapping direct, indirect, and emerging competitors. |

| 2. Benchmark | To measure your performance against competitors using key metrics. | Gathering data on product, marketing, sales, and customer experience. |

| 3. Strategize | To translate analytical findings into concrete business actions. | Identifying opportunities, shoring up weaknesses, and setting priorities. |

This structure ensures you move from broad discovery to specific actions without getting sidetracked.

Phase 1: Assess Your Competitive Landscape

First things first: you need to know who you’re really up against. This goes way beyond just listing your top two or three rivals. A truly comprehensive assessment involves identifying every player competing for your customer’s wallet, even if their product seems completely different from yours.

Your goal here is to sort competitors into buckets to understand the unique threat—or opportunity—each one represents.

- Direct Competitors: These are the obvious ones. They sell a similar product to the same audience. If you run a specialty coffee shop, it’s the other cafe on your block.

- Indirect Competitors: These businesses solve the same core problem for your customer, just with a different solution. For that coffee shop, an indirect competitor could be a tea house or even a brand of high-end energy drinks.

- Emerging Competitors: Keep an eye on these newcomers and disruptors. They might be small today, but their fresh approach could pose a major threat tomorrow. Think of a new delivery-only coffee subscription service popping up in your city.

One of the biggest mistakes I see is businesses fixating on direct competitors while completely ignoring the others. It's the indirect and emerging players that often reshape the entire market. A thorough assessment gives you that crucial 360-degree view.

Think of it this way: creating a complete map of your competitive universe is the foundation of your entire strategy. Without knowing all the players, you're driving with an incomplete map, blind to potential shortcuts and hidden dangers.

Phase 2: Benchmark Against Key Metrics

Once you’ve mapped out the players, it’s time to benchmark. This is where you graduate from simply identifying competitors to conducting a detailed, side-by-side comparison. The objective is to collect hard data that lets you see exactly how you stack up.

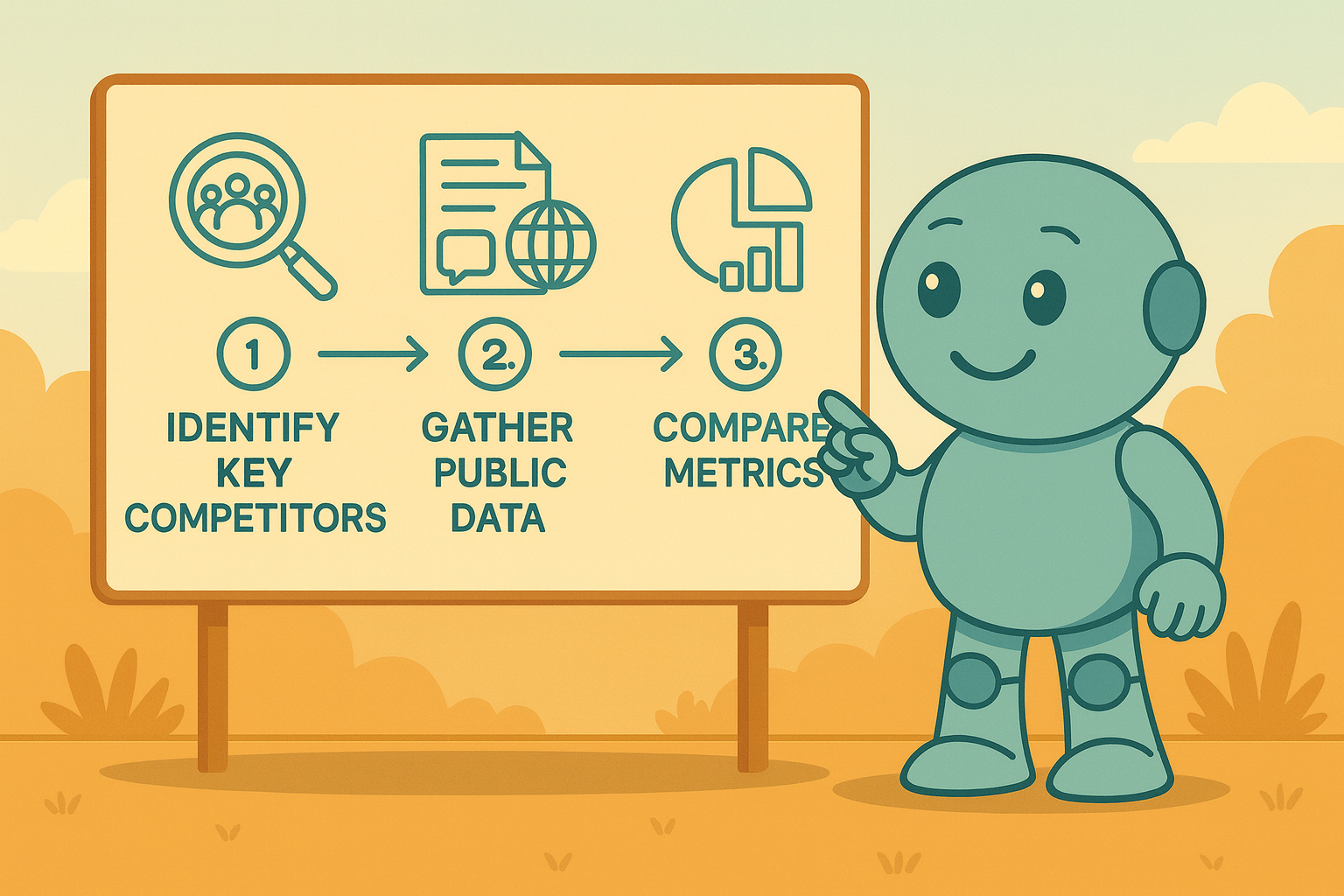

This is the core of the process—moving from identification to intelligence gathering and then to direct comparison.

As the visual shows, it’s a clear progression from a wide lens to a microscope, which is exactly what effective benchmarking feels like.

When you start gathering data, aim for a balanced scorecard. Don't just look at one thing. You should be tracking:

- Market Position: What’s their market share? How is their brand perceived? What’s their share of voice online?

- Product Offering: Break down their key features, pricing models, and what they claim as their unique value.

- Marketing & Sales: Look at their website traffic, social media engagement, and try to piece together their sales funnel.

- Customer Experience: What are people saying in online reviews? What kind of customer support do they offer?

It's vital to gather this information ethically. Stick to public sources like company websites, annual reports, press releases, and industry news. This phase is all about getting the objective proof you need to back up your strategic bets.

Phase 3: Strategize and Take Action

Here we are at the final—and most important—phase. All that data you’ve collected is worthless until it sparks a decision. This is where you connect the dots between what you’ve learned and what your business needs to do next.

Top-tier strategy consultants live by this process. The whole point of the assessment and benchmarking is to set the stage for this moment, where insights become priorities. By starting with a clear goal for the analysis, companies can align their intelligence with their planning, swapping guesswork for moves based on a deep understanding of the market. You can learn more about how leading firms apply this discipline to give their clients a better shot at success.

Your final strategic plan should answer a few pointed questions that came out of your analysis:

- Where are our competitors weak? Pinpoint the gaps in their product or marketing that you can drive a truck through. It might be an underserved customer niche or a feature they’re missing.

- Where are we vulnerable? Be brutally honest about where your competitors are eating your lunch. This tells you exactly where you need to invest to defend your turf.

- What market opportunities did we just uncover? Look for the "blue oceans"—untapped market needs that nobody is addressing well right now.

- What are our top 3 strategic priorities? You can't do it all. The final step is to distill everything into a handful of high-impact initiatives that will actually move the needle for your business.

Taking this last step is what ensures your competitive analysis framework isn't just some dusty report sitting on a shelf. It becomes a living, breathing tool that actively builds your company's strength and resilience.

The Key Metrics You Need to Track

A competitive analysis framework is only as good as the data you feed it. Without the right numbers, you’re just guessing. To really get under the hood of a competitor's strategy and see what’s working, you need to track specific, measurable metrics that tell a story.

Think of these metrics as the vital signs for your rival's business. A doctor wouldn't just take your temperature; they'd check your heart rate and blood pressure, too. In the same way, you need a balanced set of metrics to get a complete picture. I generally group these into three core areas: market performance, customer sentiment, and marketing effectiveness. Let's dig into what to watch in each.

Measuring Market Performance

This first bucket is all about the big-picture business results. These are the numbers that get splashed across shareholder reports and press releases because they signal a company's overall health and where it's headed.

Here’s what to keep an eye on:

- Market Share: This is the slice of the pie a competitor owns, usually measured as a percentage of total market sales. If their share is growing, they're successfully poaching customers. If it's shrinking, something in their strategy might be broken.

- Revenue and Growth Rate: Tracking a competitor’s revenue—especially their year-over-year or quarter-over-quarter growth—is a direct indicator of their financial momentum. Consistent, healthy growth is a tell-tale sign of a winning strategy.

- Pricing Strategy: Take a close look at their pricing. What are their entry-level costs? Their premium tiers? How often do they offer discounts? This tells you exactly how they position themselves. Are they the budget-friendly option or the premium choice? This choice directly shapes their profitability and who they sell to.

Understanding Customer Sentiment

While market performance metrics tell you what is happening, customer sentiment explains why. These metrics give you a read on how people actually feel about a competitor’s brand, products, and service. Happy customers are a powerful defense against rivals.

A core component of any competitive analysis framework is using specific metrics that quantify competitors' market performance. Research highlights that tracking metrics like market share, growth rates, customer loyalty, and pricing strategies is crucial for a complete picture. High customer retention rates, for instance, signal that a competitor's value proposition is resonating strongly, which is a massive advantage given that acquiring new customers can cost five times more than keeping existing ones. For more detail on these essential metrics, you can explore the full analysis on how systematic tracking informs effective strategy formulation.

To get a real sense of customer sentiment, you need to look at:

- Net Promoter Score (NPS): This classic metric cuts right to the chase by measuring customer loyalty. A high NPS means they have a vocal army of fans who are happy to recommend them.

- Customer Retention and Churn Rate: This shows you how many customers stick around versus how many walk away. A high retention rate—or "stickiness"—is a great sign that their product or service is delivering real value.

- Online Reviews and Ratings: Scour sites like G2, Capterra, or even Yelp. These platforms are a goldmine of honest feedback, highlighting not just what customers love, but more importantly, their recurring frustrations and complaints.

Gauging Marketing Effectiveness

Finally, you need to understand how your competitors are getting noticed. These metrics reveal how well their marketing engine is running, where they’re putting their money, and which channels are actually delivering results. After all, a great product doesn't sell itself.

Key marketing metrics to track include:

- Share of Voice (SOV): This measures how much of the conversation a competitor owns compared to everyone else. A high SOV across social media, search results, and industry forums means they are dominating the discussion.

- Website Traffic and Sources: Use tools to estimate their web traffic and see how many people are checking them out. Digging into the sources—like organic search, paid ads, or social media—reveals which marketing channels are their heavy hitters.

- Social Media Engagement: Don't get distracted by follower counts. The real story is in the engagement. Look at their likes, comments, and shares to see if their audience is genuinely interacting or just passively scrolling. A memorable brand name plays a huge role here, so it’s worth avoiding common brand naming mistakes that can hurt engagement.

Putting Your Analysis into Practice

Theory and models are one thing, but a competitive analysis framework really proves its worth when you put it to work. Let's step away from the abstract and explore two real-world scenarios. These examples will show you exactly how different businesses can use a framework to cut through the noise and build a smart, actionable strategy.

First, picture a new tech startup, "ConnectSphere." They’re aiming to make a splash in the project management software market, a space currently dominated by an industry giant, "TitanTask." The team at ConnectSphere is sharp; they know going head-to-head with the titan is a losing battle. They need to find a chink in the armor—a gap TitanTask has ignored.

The Startup Finds Its Niche

The ConnectSphere team opts for a hybrid approach, combining a classic SWOT analysis with a detailed feature comparison. They dive deep, pulling data on TitanTask’s market share, sifting through customer reviews, and mapping out every product feature. A clear pattern emerges almost immediately.

TitanTask is undeniably powerful, but it’s also clunky and expensive. It’s built for massive corporations, leaving smaller, non-technical teams like marketing agencies or event planners feeling completely overwhelmed.

This single insight becomes the cornerstone of their entire strategy. The analysis didn't just tell them who their competitor was; it revealed a specific, underserved group of customers whose needs were being ignored.

From there, ConnectSphere’s own SWOT analysis clarifies their path forward. Their key strengths are agility, a clean user interface, and lower operating costs. The opportunity is staring them right in the face: build a tool for small agencies that need simple collaboration without the enterprise-level baggage.

This insight translates directly into a focused plan:

- Product: They’ll concentrate development on features essential for creative collaboration and consciously avoid the complex functions that bloat TitanTask.

- Marketing: All content will speak directly to the frustrations of marketing managers and event coordinators.

- Pricing: They'll launch a flexible, affordable pricing tier specifically for teams with fewer than 10 members.

The Retailer Fights Back

Now, let's shift gears to a completely different industry. Meet "The Gilded Page," a cherished local bookstore. For decades, it thrived on a loyal community following. But now, it's fighting a war on two fronts: massive online retailers slashing prices and trendy new "book cafes" opening up downtown. The owner is feeling the pressure and doesn't know where to focus their limited resources.

To gain some clarity, the owner decides to use a framework centered on benchmarking the customer experience and marketing tactics. They start by analyzing their competitors, both online and local. This involves some old-school detective work: visiting the cafes, monitoring their social media, and reading hundreds of customer reviews.

The analysis delivers a crucial piece of intelligence. While the online giants always win on price, their service is cold and impersonal. Meanwhile, the local cafes have a great vibe but offer a very limited, mainstream book selection. This information is gold. For more ideas on how to stand out, our guide on how to choose a business name offers great tips on differentiation.

The Gilded Page's strategy begins to take shape, built around its unique advantages. They know they can't win a price war, so they'll win on curation and community. Their action plan becomes clear: launch a personalized book recommendation service, host more author meet-and-greets, and create a loyalty program that genuinely rewards local shoppers.

In both of these stories, the right framework provided the structure needed to transform market chaos into a clear roadmap for success.

That first big competitive analysis? It's a goldmine of insight. But its real power isn't in that initial "aha!" moment. The true value comes when you stop treating analysis like a one-off project and start weaving it into the very fabric of your business.

Think of it this way: a static report is a snapshot that starts aging the second you print it. A living, breathing analysis process, on the other hand, is like a GPS for your business—constantly updating, rerouting, and keeping you on the fastest path to growth.

The goal is to embed competitive intelligence into your company's daily rhythm. You want to create a continuous feedback loop where fresh market insights don't just sit in a folder; they directly shape your product roadmap, fine-tune your marketing campaigns, and arm your sales team for every conversation.

From Report to Routine

So, how do you make this shift? You operationalize it. You turn the ad-hoc scramble for information into a reliable, repeatable system that runs in the background, consistently feeding your teams the intel they need to win. It’s about building a strategic habit, not just completing a task.

Here are a few practical ways to get started:

- Set a Regular Cadence: Don't wait for a fire drill to figure out what your competitors are doing. Get ahead by scheduling your analysis. This could be a comprehensive deep dive every quarter, supplemented by quicker monthly scans of the landscape.

- Assign Clear Ownership: Make someone accountable. When a process is everyone's responsibility, it quickly becomes no one's. Designate a point person or a small team to drive the collection, analysis, and, most importantly, the distribution of insights.

- Create Centralized Dashboards: Keep the insights visible and accessible. A simple dashboard that tracks key competitor metrics right alongside your own KPIs is a powerful tool. It keeps the market front and center during every strategic discussion.

The most successful companies don’t see competitive intelligence as a research project they commission every few years. They treat it as an ongoing program. They get that the market is always in motion, and the only way to stay ahead is to keep your eyes open.

Ultimately, integrating a competitive analysis framework into your daily operations does more than just keep you informed. It makes your entire organization more responsive and better prepared for whatever comes next. You’re no longer just reacting to market shifts—you’re anticipating them. And that proactive stance is one of the most powerful long-term advantages you can build.

Frequently Asked Questions

Diving into competitive intelligence often brings up a few practical questions. It's completely normal to wonder about the nitty-gritty details as you start building out your competitive analysis framework. Let's clear up some of the most common ones so you can move forward with confidence.

Getting the timing, tools, and ethics right is what separates a one-off report from a powerful, ongoing strategic asset.

How Often Should I Update My Analysis?

There isn't a magic number here—it really depends on how quickly your industry moves. For most businesses, a comprehensive deep-dive every quarter is a great rhythm. This gives you a regular, structured checkpoint to see what's changed in the market.

But if you're in a fast-paced field like tech or e-commerce, you'll want to do a lighter monthly review. This helps you spot new features, sudden marketing campaigns, or emerging trends before they start to pull ahead.

Think of it this way: your quarterly analysis is a full physical exam, while the monthly check-ins are like monitoring your vitals. You need both to get a complete picture of your competitive health.

What Are the Best Tools for Different Budgets?

You don't have to break the bank to get incredible insights. There are fantastic tools available at every price point, so you can start small and scale up as you grow.

Here’s a quick look at your options:

- Free Tools: Don't underestimate the power of Google Alerts and the built-in analytics on social media platforms. You can learn a surprising amount just by tracking competitor names and keywords without spending a dime.

- Mid-Range Tools: This is where you get serious bang for your buck. Services like Semrush or Ahrefs offer a treasure trove of data on SEO, keyword rankings, and backlink strategies, essentially letting you look under the hood of your competitors' digital marketing.

- Enterprise-Level Platforms: For larger companies that need a constant pulse on the market, platforms like Crayon or Kompyte are the answer. They automate intelligence gathering in real-time, tracking everything from subtle website tweaks to major product launches.

How Can I Gather Intelligence Ethically?

This is a crucial point. Ethical competitive intelligence is about being a sharp detective, not a spy. The golden rule is simple: stick to information that is publicly and legally available. Never resort to shady tactics like misrepresenting who you are or trying to gain access to private documents.

Focus your energy on information that companies want the public to see. This includes:

- Their own websites, blogs, and press releases

- Publicly filed financial reports

- Social media activity

- Customer reviews on sites like G2 or Capterra

- Industry reports and market analysis

By staying on the right side of this line, you can build a powerful and insightful analysis with your integrity fully intact.

Ready to create a name that stands out from the competition? The powerful tools at NameRobot can help you generate, evaluate, and secure a market-ready brand name. Start your naming journey today.